The main purpose of a permanent account number, introduced by India’s Income Tax Department, is to act as a unique ID for tracking financial transactions, tax filings, and compliance. It helps make everything more transparent, traceable, and organized.

But for many people—especially NRIs and foreign nationals—getting a PAN can feel confusing. That’s because the process isn’t one-size-fits-all. There are different application forms depending on who you are: individual, company, trust, LLP, HUF, government body, foreign citizen, OCI, minor, etc.

So whether you’re an Indian citizen, an OCI, a foreign national, or an organization, it’s important to know which form is right for you.

That’s where we come in. At pancard.co.uk, we make the PAN application process easy and stress-free. We break down the differences between forms like 49A, 49AA, and CSF, and guide you based on your situation—especially if you’re applying from the United Kingdom (UK).

Please note, there isn't just one standard PAN application form that fits all cases. There are actually three different types of forms, and it's important to choose the right one based on your specific need. Picking the wrong form can lead to delays or rejection.

| Feature | 49A | 49AA | CSF |

|---|---|---|---|

| Purpose Of The Form | This application form is used for applying a fresh new PAN number by someone who never applied before. | This form is used for obtaining a new PAN card by someone who never applied for one before. | This form is used for requesting a correction, change in an existing PAN card, or getting a duplicate copy reprinted. |

| Applicant Category (Nationalities) | This form is for Indian citizens, non-resident Indians (NRIs), companies and organizations incorporated in India. | This is for entities incorporated outside India and foreign nationals with or without an OCI or PIO card. | This is for all kinds of applicants, like Indian residents, NRIs, foreign citizens (including OCI/PIO card holders), and entities incorporated in India or abroad. |

| Structure | Two-page form, with an extra 6 pages of instructions. | 3-page form, excluding 5 pages of instructions. | Single-page form with an added 2 pages of instructions. |

| Address Details | Permanent and communication address required. | Permanent and communication address required. | Address details required, including details of representative in India. |

| Fee | Rs. 117 for Indian address, Rs. 1,017 for foreign address. | Rs. 117 for Indian address, Rs. 1017 for foreign address. | Rs. 117 for delivery within India, and Rs. 1017 for a foreign address. |

| Documents Required | Proof of identity and address documents. | Proof of identity and address documents. | Proof of identity, address, and representative documents. |

| Proof of Identity | Indian citizenship proof required (Aadhaar, Voter ID, Passport, etc.). | Proof of identity required (Passport, PIO card, OCI card, etc.). | Proof of identity required (Passport, PIO card, OCI card, etc.). |

| Proof of Address | Address proof required (Aadhaar, Voter ID, Passport, Utility bill, etc.). | Address proof required (Aadhaar, Voter ID, Passport, Utility bill, etc.). | Address proof required (Aadhaar, Voter ID, Passport, Utility bill, etc.). |

| Submission | Can be submitted physically or online. | Can be submitted physically or online. | Can be submitted physically or online. |

| Processing Time | Generally takes 15-20 working days. | Generally takes 15-20 working days. | Generally takes 15-20 working days. |

| Photos to be Pasted | Two photos required. | Two photos required. | Two photos required. |

| Where To Download? | Official website of Income Tax Department and TIN-FCs. | Download it right here from the Official website of Income Tax Department and TIN-FCs. | Official website of Income Tax Department and TIN-FCs. |

| Where To File Online (electronically)? | Applicant can file it on UTIITSL, NSDL, PROTEAN TIN website or on any authorized PAN agency e-platform. | On NSDL, UTIITSL, PROTEAN TIN or on any authorized PAN agent's website. | On NSDL, PROTEAN TIN, UTIITSL or on any PAN agency website. |

| Where To Submit Or Send Physically? | One can submit the application by visiting any of the branches of NSDL, PROTEAN, UTIITSL or PAN agent. | Submit it in any branch office of UTIITSL, PROTEAN, NSDL or PAN agency. | You may submit it at any of the branches of the UTIITSL, NSDL, PROTEAN or PAN agent's office/branches. |

Be advised that the above table is for general information only, and the details provided might not be accurate. Thus, it is highly recommended that you refer to the official sources for the most accurate and current information.

A PAN card is a must-have document not just for resident Indians, but also for NRIs, foreign nationals, companies, and entities without a presence in India. It’s needed for a range of financial activities—like investing, opening bank accounts, filing taxes, getting lower TDS (withholding tax) rates, or claiming TDS refunds. Whether you’re applying for a new permanent account number, or need to update or correct details in your existing one, it’s important to use the right form based on your category. This helps avoid delays and keeps the process smooth and hassle-free.

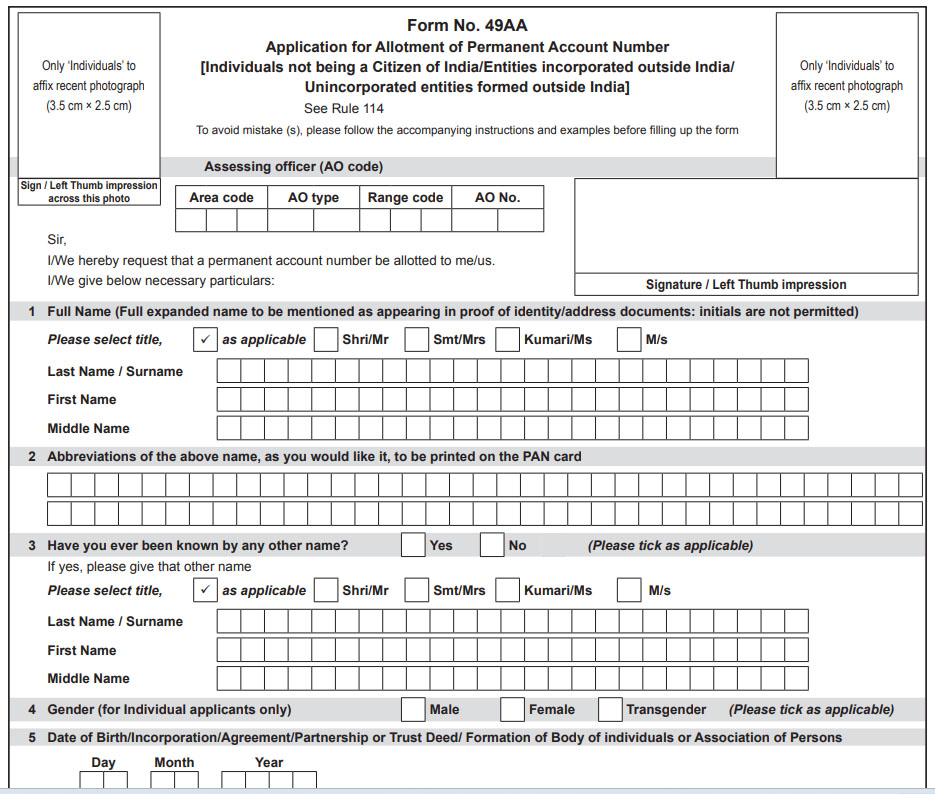

This application form is similar to the 49A form, but it’s specially designed for foreign nationals (including PIO and OCI card holders) and companies that are not registered or based in India.

- It must be filled out in English or Hindi.

- If you're applying as an individual, you’ll need to attach a valid passport and proof of residence.

- If you're applying as a foreign company, you must include the Memorandum of Association and Articles of Association.

You also need to provide your foreign address, citizenship details, and other relevant information based on your case.

All supporting documents must be submitted with the form, including a self-attested passport copy and a passport-size photo.

Once approved, both the e-PAN (electronic version) and physical PAN card will be sent to your overseas (foreign) address.

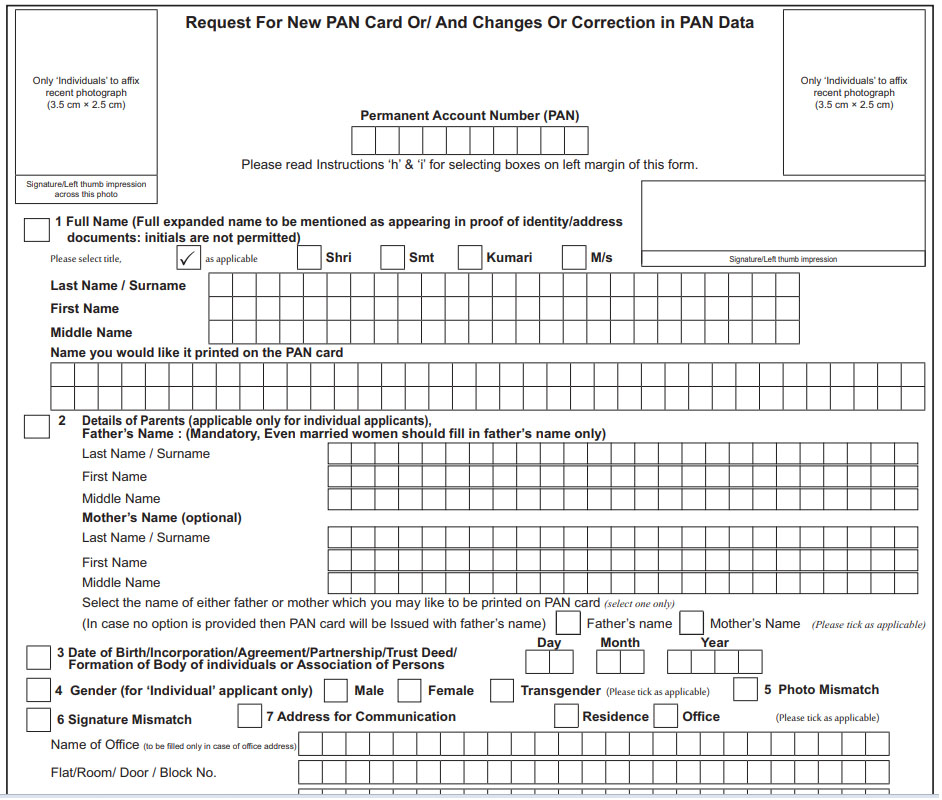

If you want to update or correct your PAN card details, or get a duplicate copy, you’ll need to fill out Form CSF. This form asks for your full name, father’s and mother’s names, date of birth, email, mobile number, your current address, and existing PAN card details.

You also need to attach a valid government-issued photo ID and sign and date the form yourself. Along with that, you must submit supporting documents for whatever change you're making—like name, address, or date of birth—and a copy of your old PAN card.

CSF application is available both online and in physical form. You can download it from the official websites of the Income Tax Department, PROTEAN, NSDL, UTIITSL, or through an authorized PAN agent in the UK.